Get Organised for Tax Time with the ATO App: A Solopreneur's Guide

Are you a solopreneur or freelancer based in Australia? Do you dread tax time because it means hours of scrounging around for missing invoices, receipts and financial records?

Well, fear not! The Australian Taxation Office (ATO) has created an app that can help simplify the process.

This guide explains how you can tap into this free ATO app to stay organised & tackle tax season without breaking a sweat!

What is the ATO app?

The ATO app is a free mobile app for Australians, specifically sole traders and individuals, that allows you to easily access personal tax & superannuation info, as well as manage your taxes by using features such as:

MyDeductions tool to track mileage, expenses & deductions

Calculate tax payable on your income via the Tax Withheld Calculator

Access to your tax records, student loan debt (HELP) & superannuation balance

Send & receive secure messages to the Australian Taxation Office (ATO)

Payment reminders & important info regarding your financial obligations

News & updates from the ATO to keep you in the loop

Using the ATO app can help to provide quick, high-level access to important tax-related info in one central [mobile-friendly] location. This makes it easier to stay on top of your tax obligations come tax time.

How can it benefit you & your business?

If you’re a freelancer or sole trader running a small biz in Australia then your business tax return likely forms part of your individual tax return and, as such, it’s easy to lose track of what is what.

If you’re anything like me, my financial records were a complete mess when I first started out as a freelancer – mostly because I found it confusing the way everything was submitted together with the individual tax return, blurring the lines between business tax and individual income tax. Also, as a newbie business owner, it was challenging to understand which expenses are claimable as tax deductions and which aren’t.

This is where the ATO app can alleviate some of the confusion and tax-time pain – by uploading your expenses and mileage directly into the app and letting the tax office crunch the numbers for you 🙌🏼

Expense reporting on the go: If you’re a sole trader in Australia then you can upload business expense receipts and track mileage directly within the ATO app to keep your tax records up-to-date throughout the year.

Key features

Here are the main ways the ATO app can help you stay on track of your taxes & financial info:

Submit tax returns (sole traders & individuals only)

Claim tax deductions – mileage & expense reporting

Tax Withheld Calculator – calculate expected taxable amounts on income

Overview of income + superannuation balance

Reminders of important dates for lodgements & payments

Business Performance Check – benchmark your business finances against other small businesses

View your list of tax accounts & any tax owing

Update personal details on ATO account (ph numbers, email, address etc)

Getting started

Download the free ATO app on the Google Play or App Store (mobile only)

Log in with your MyGov details (or create a MyGov account if you don't yet have one)

Check personal details & update accordingly (recommend doing this prior to submitting a tax return!)

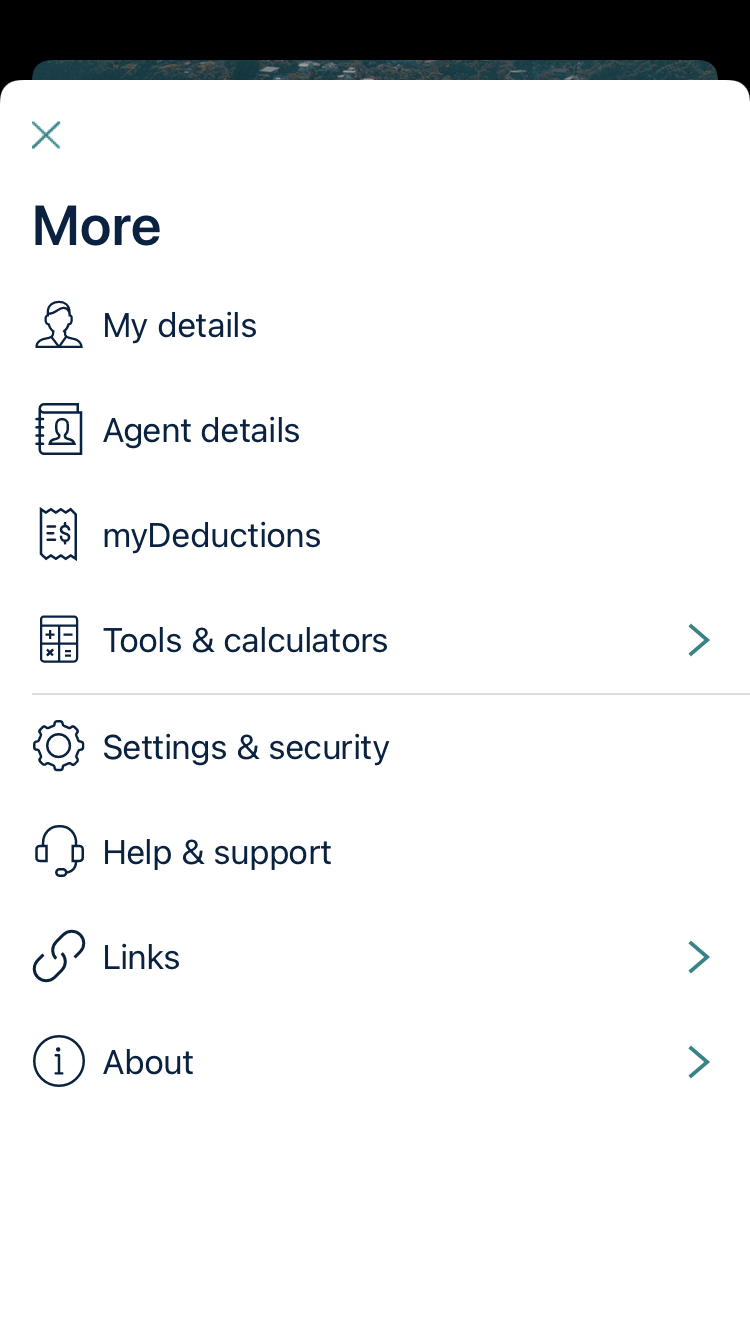

Report expenses by uploading receipts & info – click on the 'more' ellipsis option in the bottom right-hand corner of the app & click through to the 'MyDeductions' tool.

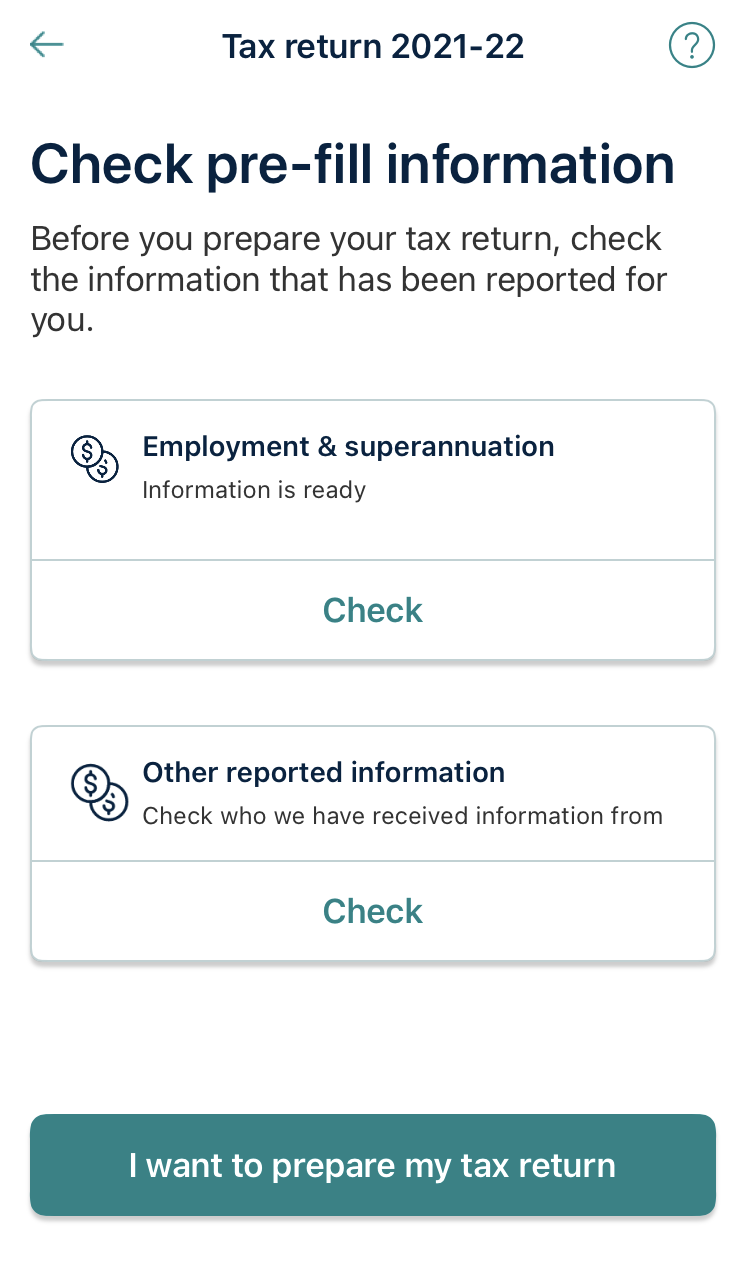

Submit your tax return by tapping on the white 'Your tax return for 2022-23' button on the home screen & follow the tax return submission process.

Pro tip: Capturing your mileage and expense receipts directly within the app throughout the year is a fabulous habit to nurture and will make tax time sooo much more enjoyable! 👌🏼