Meet Hnry: The Unsung Hero Saving Solopreneurs From Tax Time Stress

Disclaimer: All information provided is educational in nature only and should not be considered official financial advice. I am not an authorised financial expert, just a fellow solopreneur looking to provide guidance and helpful info!

As you likely know, one of the common struggles when starting out as a solopreneur, freelancer or side hustler is figuring out the financial side of things – it can be confusing, time-consuming & downright daunting! An avoidable problem that Aussie fintech startup, Hnry, has set out to solve – creating a clever tax automation tool and all-in-one business finances app for sole traders 🙌🏼

What is Hnry?

Bringing together business banking, invoicing, expense reporting and tax filing under one roof, Hnry is one hell of a find for sole traders. By streamlining and automating the financial side of your business via this one powerful platform, you get more time to focus on what matters most – growing your budding business 🚀 (without blowing the budget!)

Not quite a bank, yet not quite accounting software – Hnry is a unique financial management platform and app built specifically for sole traders to streamline their business finances processes (and avoid headaches at tax time!)

In a nutshell, it offers the ability to:

Open a transactional business bank account

Track and report business expenses

Quote, invoice and receive client payments

Generate payslips and view revenue received

Pay yourself superannuation

Calculate any tax due and pay it directly to the tax office (ATO)

File your tax return for you

Auto-allocate a portion of your income to savings accounts, investments or giving back

All these features can be accessed either via the desktop platform or mobile app, which is a pretty sweet and seamless experience that offers embedded mini tutorials and prompts that help you along the way 😍

NB: Hnry is currently only available for sole traders in Australia and New Zealand. If your business forms part of a company structure and/or operates out of a different country then you won't be eligible to use Hnry (at this point in time anyway!)

How does Hnry work?

Hnry works by bringing all your business banking, accounting and tax filing in-house to the Hnry platform. There are no fees or start-up costs to get started (a refreshing and welcome change for freelancers and sole traders, I'm sure!), and you can open your account and get set up online in under 15 minutes.

When you create your Hnry profile, the platform will automatically open a bank account for you with a BSB number, account number and PayID dedicated to your business banking needs. From there, you can start to import or add your business finances info and begin using the app to manage your finances.

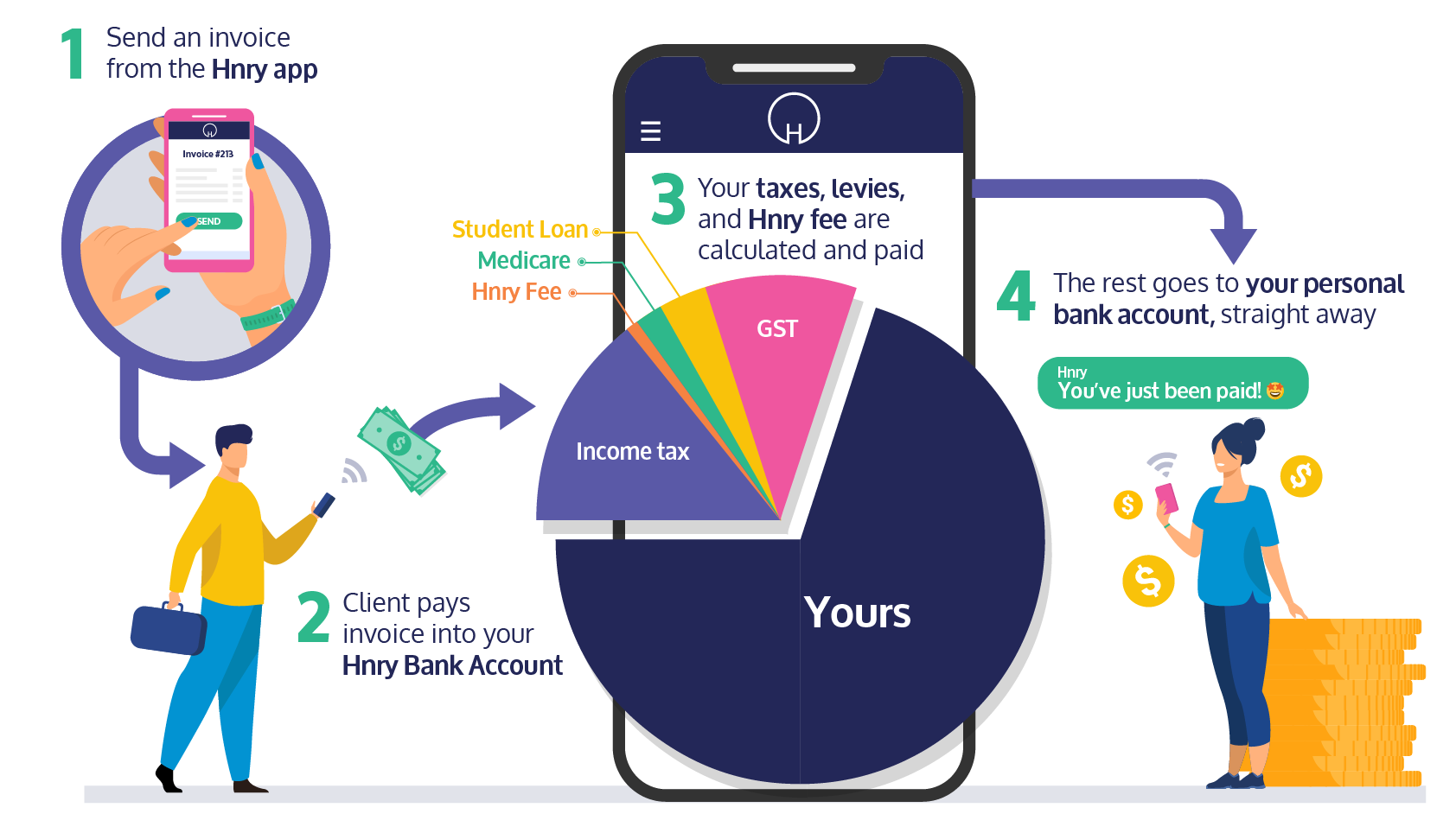

The general process for using Hnry works like this:

Invoice a client via the invoice function within the Hnry platform.

The client pays the invoice either via credit card or direct bank transfer. These funds are sent to your Hnry bank account.

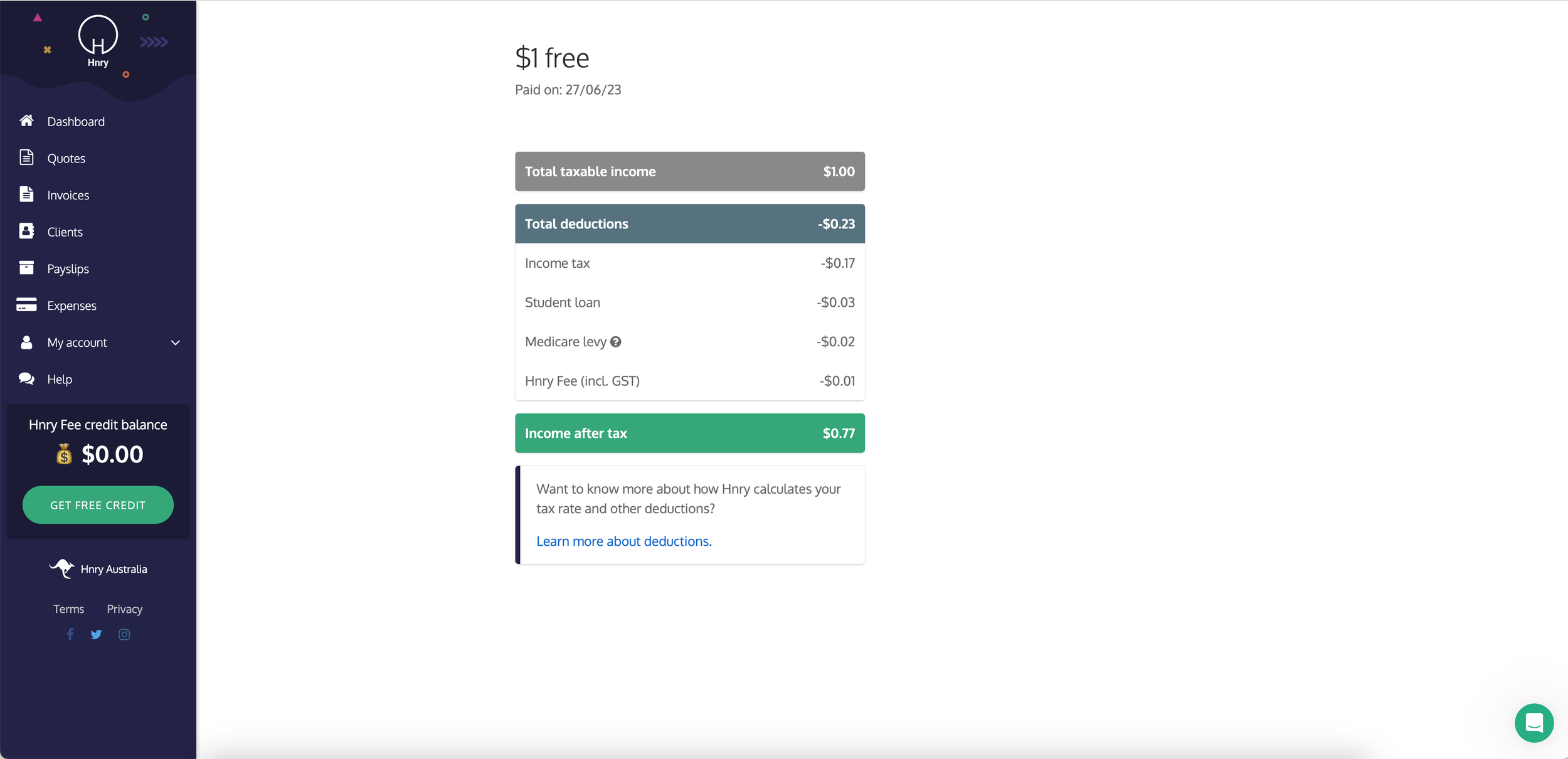

The Hnry app calculates and deducts any tax or student loan debt you owe and pays it directly to the tax office.

The remaining money (aka the profit) is then automatically paid directly into the personal bank account you nominate.

NB: Hnry makes its calculations and deductions based on the business and tax information you've provided within your profile so be sure to configure your accounting settings first!

How can it benefit you & your business?

Say #bye to manual data entry

The era of spreadsheets has come and gone – by all means, continue crunching the numbers if it helps you sleep at night but with the likes of Hnry and the automated accounting bliss it brings, spending hours suffering amongst spreadsheets is no longer a necessity 🥳

Avoid costly tax penalties

Concerned about paying penalties to the ATO due to missed deadlines or incorrect calculations? Hnry ensures that your taxes are accurately calculated and filed on time, giving you peace of mind and avoiding costly penalties...(you may even get a cheeky tax return back, whoop!)

Simplify your accounting & tax processes

Step into this one-stop-shop solution for your accounting and tax needs – Hnry provides everything you need in one easy-to-use platform, making it simple and stress-free to manage your finances.

Only pay for what you use

No fees, no subscriptions, no stress – Hnry's unique payment structure means that rather than pay any upfront or ongoing fees, you just pay a 1% commission through payments processed within the platform. As a previous freelancer myself, I gotta say, this is hella refreshing and a godsend for those of us solopreneurs just starting out who are struggling to balance the books!

Hnry vs accounting software

While Hnry offers a powerful platform for automating your tax obligations and financial processes as a solopreneur, the scope is limited when it comes to financial reporting and detailed data. As a tool designed to simplify financial management for freelancers and sole traders, the simple reporting functions are likely intentional to reduce overwhelm.

If you’re at a stage of your business where you’re looking to scale, or you’re someone who likes to delve into revenue reports and analyse financial data to gain insights for business growth purposes then you may want to consider investing in a more robust accounting software option such as QuickBooks, MYOB, FreshBooks or Xero (my rec is QuickBooks).

Getting started

Open a free account at hnry.io

Go through the onboarding steps & add your account info as prompted (personal bank acc, ph number, DOB, TFN, address, ID)

Register for a sole trader ABN (if you’re in Australia & don't already have one) and add this to your Hnry profile.

Begin building and migrating your financial processes into the Hnry platform & customise your account with your branding and business information.

Get into the habit of using Hnry for all your financial management needs and enjoy that sweet, sweet feeling of knowing your numbers & the fact that you owe ZERO tax! 🤩

Pro tip: Be sure to get your all your business information, tax registration details and account settings sorted out prior to sending any invoices or quotes – this will ensure the correct business info is listed on your documents and Hnry profile, and your taxes and deductions are calculated correctly.